The boom in digital banking has led users to reinforce their security as much as possible with practices such as regularly changing passwords, not using public networks for transactions or not providing personal access data to third parties.

Digital banking in Spain has experienced considerable progress in recent years as a result of the substantial investments undertaken by the sector in innovation and digitalisation of financial products and services. Currently, 50% of banking customers are already digital, and in some banks this percentage is as high as 70%. Undoubtedly, the ability to access digital financial services brings significant benefits to users: agility, accessibility and convenience, among others. At the same time, however, potential risks emerge, forcing financial institutions and users to reinforce security measures as much as possible.

Internet traffic has grown globally over the last two years due to the increase in many digital activities. Many companies have been forced to speed up their digital transformation. The shift towards remote working and learning has boosted demand for cloud services and connectivity, accelerating the digital economy and the growth of network traffic. In addition, the number of users with Internet access has increased worldwide and more than half of the world's population now uses mobile Internet.

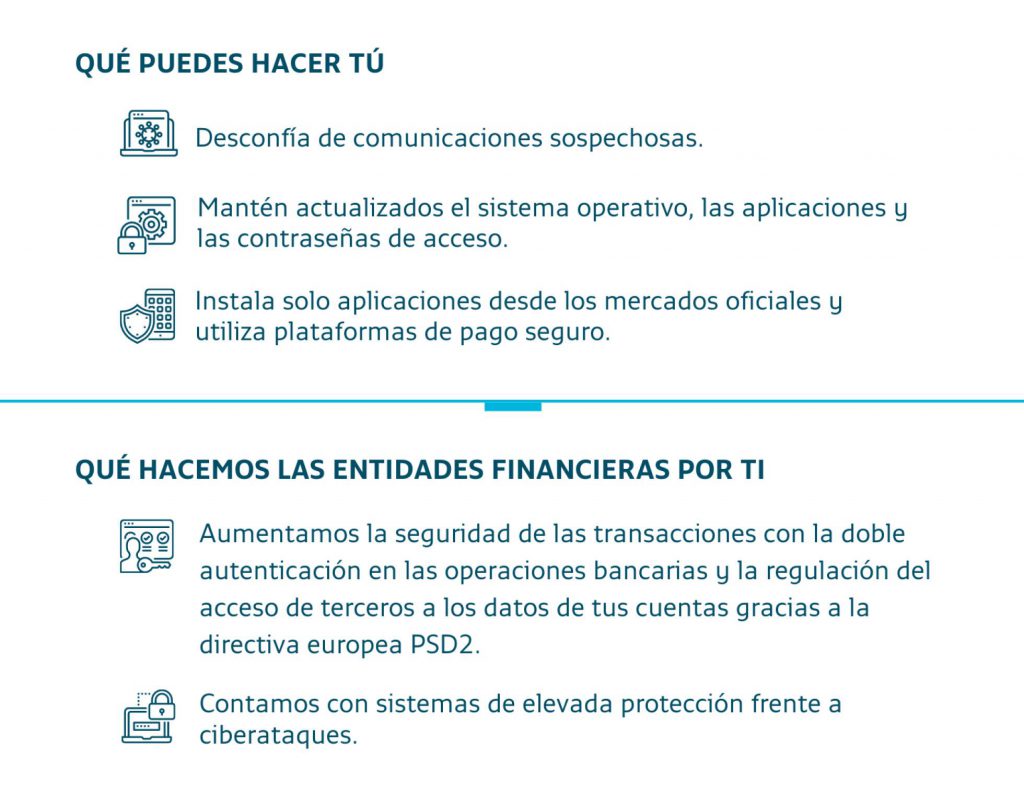

Financial institutions are turning to technology as a method for protecting both their customers' data and their bank accounts. In this regard, apart from the classic recommendation to select strong passwords and change them regularly, they are also implementing new security methods and working to facilitate more convenient access through their digital applications.

In addition, the European PSD2 Directive has reinforced the security of electronic authentication systems. Thus, all payments are subject to reinforced measures when verifying the user's identity.

CECA's member entities (CaixaBank, Kutxabank and Cajasur Banco, Abanca, Unicaja Banco, Ibercaja Banco, Caixa Ontinyent, Colonya Pollença and Cecabank) have compiled the following advice on how to protect your finances on the Internet.

Besides the security applications implemented by financial institutions, customers are also advised to take certain precautions to avoid security breaches. To this end, it is advisable not to share passwords for accessing mobile banking with anyone, nor the code or pattern for accessing devices (smartphones, tablets or computers). At the same time, users are asked to configure their mobile devices with the automatic blocking option. This can be done by PIN, unblocking pattern, digital fingerprint, or through the facial recognition tool if available on the mobile phone.

Users should also refrain from entering private data on public Wi-Fi networks, as some of these open networks can be used to spy on data traffic. This facilitates the capture of usernames, passwords and other information, which is then used fraudulently.

As for passwords, users are requested to change them regularly and to use combinations that involve a certain degree of difficulty. These should not be saved on mobile devices or on the computer. Bank account numbers, debit or credit card numbers should also not be stored, as these are confidential data. If the devices are stolen, the offender would obtain sensitive information from the personal equipment.

To reinforce security, no personal or financial information should be provided through calls, messages or emails. Lastly, any suspicious activity should be reported to the bank immediately. There are many aspects that influence banking security. Fortunately, and with the help of technology financial institutions are taking steps to reinforce and safeguard the security of their customers' data.

For further information, please visit the website Nuestros Datos Seguros, and if you want to keep up to date with security tips follow its Twitter, Facebook and LinkedIn profiles.